04 January . 2024

2024 housing market predictions: lower rates & more choice

What is going to happen with the housing market in 2024? With a spike on Google Trends at the end of the year, it’s clear that many wish they had a crystal ball. Popular searches like “Will interest rates go down?” or “Is there a housing crash coming?” return millions of results.

To help you narrow down the answers to these questions and more, we’ve done the research and gathered 5 professional housing market predictions to shed a little light on what economic and real estate experts are saying as we head into the new year. If you’ve been thinking about buying a new home in 2024, read on.

Will home prices in Portland, Oregon drop in 2024?

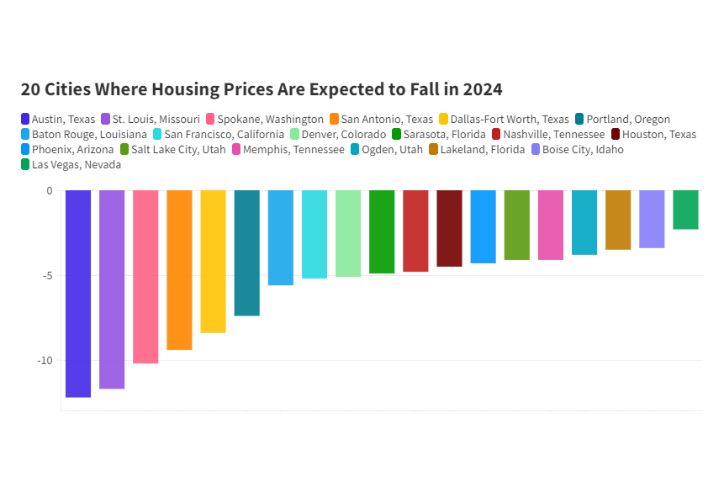

Newsweek says: “Twenty cities in particular are expected to see significant drops in housing prices in the coming year.” The accompanying infographic (pictured above) shows Portland, OR expected to see a 7.4 percentage decline in home prices. The article goes on to explain, “The projected shift in the housing prices is part of a broader trend influenced by several factors…including elevated mortgage rates, changes in buyer behavior, and the evolving economic climate.”

Will mortgage rates go down in 2024?

Forbes says: “Would-be home buyers may finally get some relief on mortgage rates in 2024. ‘Our house view is that we will see [federal funds] rates hold steady through the end of the year and that we will see the first rate cut in March of 2024,’ says Matthew Vance, Americas head of multifamily research at CBRE.” The article also notes that “a rate decrease doesn’t have to be big to be meaningful. Saving a few hundred dollars a month thanks to a lower mortgage rate can be a game changer for some consumers.”

Will homes be more affordable in 2024?

Money.com says: “On the whole, while Realtor.com expects record-high unaffordability to wane, Americans shouldn’t anticipate a return to pre-inflation, pre-pandemic norms in 2024. Demand will probably remain low, and inventory will still be limited as would-be sellers hold back. ‘Moves of necessity—for job changes, family situation changes, and downsizing to a more affordable market—are likely to drive home sales in 2024,’ Danielle Hale, Realtor.com’s chief economist, said in the report.”

Will the housing market crash in 2024?

Morgan Stanley expects prices across the country to fall by 3% next year, according to its latest forecast model. Newsweek explains, “This drop will help the American housing market, and especially aspiring homebuyers, according to Ellen Zentner, Morgan Stanley's chief U.S. economist. ‘This comeback will be due primarily to an improvement in affordability [and] an increase in inventory, which has been a big issue in the past few years. A full-on crash of the housing market, like the one in 2008, is not in the picture.’"

Is there good news for homebuyers next year?

Zillow economists predict that in 2024, homebuyers will have more options and more affordability breathing room as homebuying costs level off. “Predicting how mortgage rates will move is a nearly impossible task, but recent inflation news gives the impression that rates are likely to hold fairly steady in the coming months. Taken together, the cost of buying a home looks to be on track to level off next year, with the possibility of costs falling if mortgage rates do.”

And, over on Reddit we’re seeing the best advice of all: “The best time to buy is whenever you’re ready to buy. You can’t wait for a perfect market, because it doesn’t exist.”

Are you thinking about buying a new home this year? Take a virtual tour, come by for a visit, or sneak a peek at what’s in store for the future in South Hillsboro.